Elusive crypto dream. Almost every day, you can find on the news a coin that goes parabolic. Maybe you wonder: “Why didn’t I buy it sooner?”

All you can do is hope to arrive early for the next big pump. That’s why so many people are looking for expert advice, hoping that these traders will show them the way.

Are you one of them?

If so, there’s bad news: if you follow someone’s advice (no matter how legit), you will never arrive first to opportunities. And the difference between 100x and 2x returns is how early you get into projects.

Long before anybody talks about it. And that comes down to DYOR: do your own research.

Whether you look to make profits or lower risk, short-term or long-term, research is where it all starts.

Right now, there’s probably a cryptocurrency project that’s about to skyrocket in price. The question is, are you willing to put time to find it?

If so, you’re in the right place. The following method will improve your research skills, so you can find those coins before they 100x.

How To Be Ahead Of The Herd

Cryptocurrencies are quite new, volatile markets. So it looks like a good idea to follow expert advice (and save research time). The problem is:

- When everyone listens to the same people, everyone has the same information. And the majority never make any money

- It’s not as fast as doing your own research. If you follow someone, you will never come first to opportunities. And that’s the difference between 100x and 10% gains

Maybe you don’t trust your research skills. But it’s better to get it wrong yourself than by listening to some stranger on the Internet.

And it doesn’t take too long to reach proficiency, especially when doing it step by step. If you want to lower your risk, start with fundamental analysis:

#1 Find new projects

A new project doesn’t mean to wait until your exchange lists new cryptocurrencies. Because by the time that happens, there may already be thousands of investors trading from the project’s platform.

To find coins, you go to the largest platforms: CoinMarkeCap and CoinGecko. Your first factor is the Trading Volume, which is the average filter for crypto listings:

If you sort by 24h trading volume, the order changes:

To find coins, sort your list by the highest trading volume. You then go one by one, skipping the ones you already know.

Warning: Before looking for new coins, take your time to review the ones you already know. You don’t want to discard too early a coin that may skyrocket later.

#2 Check the coin stats

Trading volume is an important factor. If it’s too low, it may mean that the project is dead, there’s not much demand, or it’s an ICO scam. There may be exceptions to this rule, but they do not happen often.

An example would be when a project does not pay much attention to marketing itself and is at that time only focused on building. At such times it may be normal for the volume to stay low, but it should rise at a certain point. If the project’s development justifies the low volume based on your own research, you may still have a winner.

In all the other cases, how much volume is enough? It depends on the market cap.

Typically, altcoins will trade at about 10% of the market cap every 24h. If the capitalization were $100 million, the trading volume should be $8–10 million or higher (except with large-cap coins like Bitcoin).

The market cap comes second. It’s the number of tokens available for trade. As for the diluted market cap, that’s how much it can theoretically grow if all tokens were in circulation (which may be tied to smart contracts or mining).

Big market caps (dozens of billions) have slower price changes while small-cap markets are volatile. Because of this, investors often have two different crypto portfolios.

Based on probability, you could expect the following:

- Small-cap and low volume = Inactive project

- Small-cap and high volume = Price spike, value increase, or correlation (depends on the news)

- Big cap and low volume = Stable price

- Big cap and high volume = Price increase, which may affect small-cap coins too

It’s convenient to get into small-cap coins as they offer the best return (e.g., everybody who invested in Bitcoin this year may have seen 2–6x returns while other altcoins surged by 10–80x)

A lower cap, however, means higher risk, so it’s even more important to do your own research.

#3 Understand the project

If the coin has enough activity (10%+ volume), it’s time to learn about the project and what people are really buying.

You go to their website and find out what their project does. If they don’t have one, you can still find lots of data on social media. And if you want to know everything about it, you read the cryptocurrency whitepaper.

If the team is trying something never done before (and there’s market activity), it might be a good investment. If the project is just a feature improvement, find out what other competitors offer similar features. They are all correlated.

If the project makes sense, all competitors will grow, but whoever dominates will have the biggest price surge. But what makes one project better than another when products are almost the same?

It’s the team behind it.

#4 Learn about the team

Two teams build the same software. Would you invest in the one that never built one before or the one that already succeeded on the previous ten?

When there’s not enough market history, the team’s history can be just as insightful. At the end of the day, most crypto-projects are companies.

If the team members know about SaaS or eCommerce (e.g., Shopping.io), chances are they’ll do well with crypto too.

Another reason trading volume may be high is social interaction:

- The team does regular live streams for news

- There’s a support team answering questions on social media

- The founders join interviews to share their view of the project

You may think: “if team members buy their own token, it’s because they know it will grow in price.”

That may lead to a token allocation problem.

#5 Check the token allocation

Before you buy a promising coin, remember that there may be thousands of people who invested months before. After they make profits, if there’s no more upside, they will sell.

Thankfully, one sale isn’t enough to move the coin’s price, unless a handful of people hold most tokens. In that case, these holders will dump as soon as it goes up.

You can check for the allocation on token explorers like EtherScan:

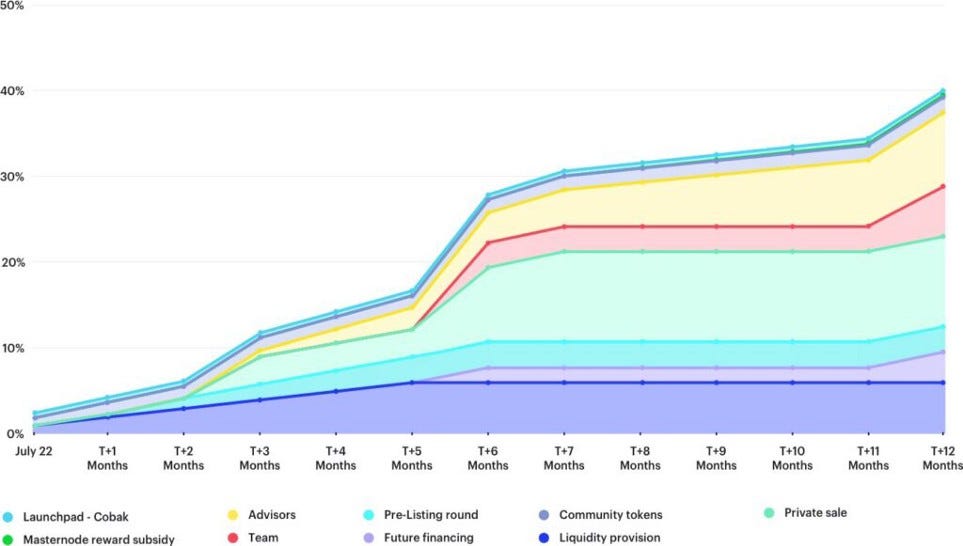

Or you may find charts like these on Messari:

The first one is a centralization example. Unless it’s a smart contract or similar, big holders (40%+) make the coin a risky investment. Because they can dump it as soon as it appreciates in value.

The second chart is how you want your investment to look like. But if you can’t find any allocation details, it’s probably like the first chart. Not good, but not bad enough to discard the project.

#6 Review their achievements and roadmap

It often looks like market perception and news move coin prices. But there’s the real value behind these projects: tech products and developers taking action.

Many great projects have lost interest because the team simply didn’t deliver on their promise. So before you invest in the next big thing, see how they’ve performed in the past.

If the project has just launched, you can instead study the team’s achievements on past projects.

Once you know that they deliver, it’s worth reviewing the upcoming updates. Since news moves prices up, the more you can find, the better.

If a software update reduces transaction costs, a small-cap coin could easily do 2x-4x.

The length of the roadmap will show whether you should invest for the short term or long term.

Do Your Own Research: Is It Worth The Time?

Market research is often the most overlooked skill in finance.

You can have a brilliant strategy. But if you’re on the wrong project, nothing will work out. On the contrary, it’s hard not to profit from research, whether it’s choosing a business niche, a crypto project, or a career.

While it may seem like you’re wasting time, research gets you paid indirectly as you get skilled. Maybe you spend days researching projects without potential. Maybe you find one that grows your portfolio 10,100 times.

Is it worth spending hours for the chance of arriving first to a potential 100x project?

If you give it a chance, you might find the next Bitcoin.