SALUTION.IO

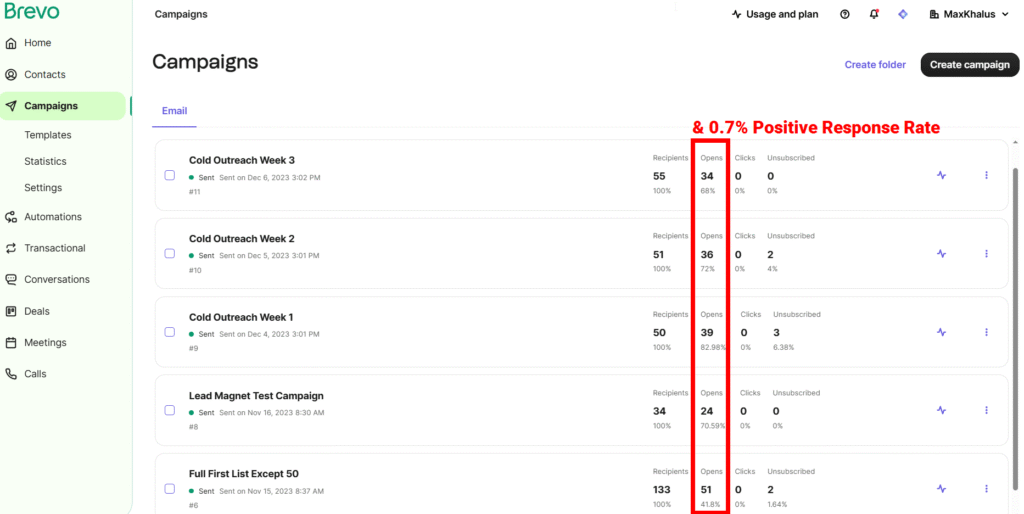

20X COLD EMAILS

20 unique variants to bypass spam filters and max out response rates

More results from other cold email campaigns...

Some of our emails hit 15% CTR after hiring Max for our launch campaign. He went beyond our expectations! We also added over 100K leads to our list within two months. Thanks!

HM Rawat

"Max was directly responsible for our traffic and email list. He took care of everything, from social media planning to the landing page... with barely any guidance or time needed from us! Appreciate everything he's done and we hope to work with him again.

Ali DBG

"He definitely sticks out as one of the top 3 best cold email copywriters we've ever engaged. The results speak for themselves. Thank you for all the great work!"

Eli Pesso

MASS COLD EMAIL VARIANTS:

With Q2 about to start, it’s normal to feel overwhelmed about your [industry] business. Finances can be messy, from unexpected expenses to more competitors, tax changes, and funding for expansions.

But it doesn’t have to be a rocky road if you have enough cushion.

For over five years, we’ve funded several successful entrepreneurs based on their business, not their FICO.

(Even with low scores, you have options for MCAs, LoC, term funding…)

This means, you receive proposals you don’t usually see at standard lenders and banks.

This is the TenX Funding Network: Url (featured on USA Wire)

P.S. If you have a lot going on in your [industry] business, this could be your fit.

Do you ever feel like your funding profile could make or break your [industry] business?

Maybe your history is short and you have to take on unfair collateral deals. Or maybe your rating is excellent, but you worry over every tiny decision to protect it.

If you want a backup, look no further than TenX: Alternative funding based on business metrics (nominated Best_Finance in USA)

Don’t put your business at risk just because of a number.

Explore your options at: Url

How has Q1 been for your [industry] business? Good or bad, can always be better with help.

But you know how it is: endless forms, annoying calls, sneaky fine print… Funding your [industry] business shouldn’t be this complicated.

Not at the TenX Funding Network.

No hard pulls, no calls, no games. Stay focused on your business and instantly receive proposals for MCAs, LoC, term funding, and more. Visit: Url

P.S. It’s a few minutes of basic info and then you’re set

We’re both too familiar with this. Maybe you’re crushing it in the [industry] business. You want to rescue your time and grow faster.

But sadly, you can’t simply trade results for funding.

And if your profile is anything less than exceptional, your business is unfairly locked out of the top choices. It’s designed to “help” those who need it the least.

That’s why, to empower entrepreneurs like you, TenX recognizes workflow metrics and the true value of your business.

(It doesn’t affect your FICO, and even if it’s low, you can build it with us.)

Conventional banks don’t show options like these.

Discover what funding you qualify for: Url

Hope you don’t mind me reaching out.

A [Industry] business very similar to yours just raised 1.2M in 48 h, and I can see how you could also speed up your business the same way. What’s better is that, without a funding record, you can match and even beat the figures from traditional banks and lenders. AKA the TenX Funding Network (awarded by Stellar Business).

It doesn’t impact your FICO rating. The program qualifies you based on business metrics. Nothing complex, just fill up basic fields in 5 min.

You’d be impressed to know how much you can raise to keep your business successful.

Find out at: Url

Spring has finally arrived but, is your {{industry}} business still in winter?

Whether it’s frozen cashflow or the slow months after Christmas, this could reawaken your dormant rainmaker. Because the Spring FastTrack Portal gives funding options based on your business results, not just FICO ratings.

Melt away funding obstacles and rediscover what your {{industry}} business is truly worth: Url

(ready in 5 minutes without background reviews)

Spring isn’t just about fresh starts… but also rapid change.

Supply disruptions, unexpected bills, more competitors… Can your {{industry}} business weather the storm?

On a rainy day, the Spring FastTrack Portal could be your greenhouse: merit-based lending to give your business the funding it deserves.

Not for the fruits of your work, but for its seed.

Start at: Url

(no borrowing history needed)

Whether you’re starting this spring with a fresh start or good momentum, it can quickly end without the right funding.

Sometimes banks and lenders simply can’t help your {{industry}} business no matter how well you’re doing.

That’s because most financing solutions aren’t made by entrepreneurs.

TenX can 10X your funding options based on true value... similar to how business leaders appraise companies to acquire.

If you want a more adaptable, risk-smart {{industry}} business, discover your options at: Url (Top Funding Firm in the USA, 2024)

P.S. Did I say it works without a FICO?

The daily grind of running a {{industry}} business can quickly become gray and tedious.

Different seasons, same problems: unplanned expenses, tax changes, supply issues, delayed cashflow, postponed expansions.

Without an excellent borrowing profile, you’re alone to bear with it.

But funding isn’t black or white.

Your business can be exceptional if they just let you prove it.

Many in our banking network (featured on USA Wire) are happy to fund your {{industry}} business if you just fill up a basic form. We don’t impact your lending rating.

Join the Spring FastTrack Portal and add vibrance to your business landscape: Url

If you’re like me, this year isn’t going as you hoped for the {{industry}} business.

Let's not forget, old problems don’t just disappear. Especially the complexities of business funding.

The good news is, the “second” start of the year has arrived for renewed energy.

Want to speed up your growth and leave old ways far behind? The Spring FastTrack Portal (we appear on USA Wire).

If you have a performing business, our network has broader options to show you than traditional banking—without impacting your funding profile.

Fill up to qualify: Url

P.S. Immediate proposal discovery on registration

Do you ever wonder where your business could be in the next three years? Maybe you’re already on track, and the one thing separating you from your goals is time.

Then, try to explain that to your banking company (be ready for hard pulls). You can’t trade results for funds.

But we do. We’ve looked at over 200,000 SMEs to help them raise funds based on their business potential, not just lending profiles.

Around our first year (2021), we funded 32M with our network of banks and alternative lenders.

Stand on the shoulders of giants and fund your business for what it can be, not just what the FICO says.

[No hard pulls] Find out in two minutes

The first best time to grow your business was last Q4. The second best time is May. Even if the winter has crippled your business, you have more funding options than banks make you think.

The Titan Force Funding Program is for those SMEs looking to push the boundaries of business. 32M worth of LoCs and MCAs have gone to business leaders without ever impacting their lending profile.

After a two-minute sign-up, within 24h you start receiving proposals from our lender network. Fund without worry: interest applies exclusively to used funds.

Why settle for traditional lending when you can have the high ground?

The other side awaits…

A business contact of mine was looking for support last month to speed up their operations.

It had every trait you would expect from successful SMEs, so they decided to go for the high-tier lending options.

It didn’t work out.

Just a few FICO points away sadly. Imagine how many businesses face these roadblocks every month.

Not with us though. While banks are too “transactional” to understand your business, Titan Funding sees its true value (and you as a partner).

So if you’re doing everything right and can’t find what you’re looking for, talk to us.

Add basic details to register, and within 24h our lending network will show you what you qualify for (no hard inquiries).

I hope you have exciting plans this spring ahead to grow your business. Or has the winter crippled your business momentum?

The bad news is, it might happen again.

Many SMEs have to postpone expansion because of unexpected expenses and debts. Just like Q4 ends in winter, before you know it, spring ends with the slow months of summer slumber.

The good news is, your FICO isn’t the one way out.

Ask any of our 100+ happy clients that were funded 32M with Titan Funding Partners. Your score isn’t your business true value… and it might be making you work harder for no reason.

So what’s the alternative?

Why bother funding your business if it’s going to be denied by a few FICO points? And what’s the alternative, if not unfair down payments?

Think again. Over 200,000 SMEs leveraged their true value, not rating, to receive fair funding. When was the last time banks looked at your full business operations?

The world of finances isn’t made for entrepreneurs, so we created Titan Funding Partners. After our first year (2021) we funded over 32M, and you could use more within 24h after the sign-up steps (it doesn’t lower your borrower rating).

Want to know what your business is worth?

Recently I found out about {{Company_Name}} and wanted to learn a bit more. It reminds me of similar SMEs run by various women entrepreneurs I connected with.

One thing they have in common is that they wanted to make more with their time.

You may relate if you’ve been in business for 3+ years and haven’t advanced as much as you wished at first. Maybe you still feel like it was yesterday when the first day began.

And while you face the same old problems, time passes. The longer it takes to build a trusted SME, the more you have to spend.

So if you value the idea of getting your business ahead, that’s exactly what we’ve done at Titan Funding Partners for hundreds of owners (over 32M funded by 2022).

Fill up this and find what’s available to you (zero hard inquiries)

Wanted to share an idea with you if you ever feel like your business has stalled.

Of course, having more resources makes it easier to grow. But unless you’re very established, there are too many hurdles to find the right help.

Imagine for a moment if it were easy…

Your business is doing so well that others want to grow with you. So you start receiving invitations to fund your business for that merit, regardless of borrowing profiles.

And if you like what you see, it’s yours within 24h. Without searching for hours, you have endless options to choose from, especially for women-businesses.

If you’d like to discover more, here’s the funding portal (no hard pulls)

Have you been with one of those brokers? You know which ones. You receive lots of proposals quickly, but they’re just not worth the premium.

Anything goes for them as long as you sign up. This is NOT what partnerships look like.

But there’s a different way:

Rather than splitting interests and avoiding risks, find a partner that shares values with you. This leads to more transparency, long-term thinking, and more involvement to actually grow your business (similar to activist investors).

Over 200,000 SMEs have taken this road, leading to priceless consulting value and 32M in funding.

Discover the right funding partner for your business (no FICO impact)

I know this is a bit random. Just found more partners providing significant increases to women-based SMEs, and I thought it made sense to show you this. Let me explain…

You’ll probably find this familiar if you’ve looked into traditional funding before. You run a successful business and take risks to grow further, but banks are risk-averse.

It’s sort of a glass ceiling where top-tier funding goes to already-grown enterprises rather than SMEs.

And we’ve helped to change that for over 200K businesses.

So if you’re tired of being a little person in a world of giants, find your Titan Funding Partners in our portal (doesn’t affect your lending score).

As part of a spring challenge, I’m connecting with women business leaders and giving them ideas (over 200,000 SMEs met since 2021).

In case you didn’t know, you’re one of them : )

I will not be “that” person claiming to grow your business when we haven’t talked yet. But I do believe you could find what you’re looking for if I invite you to the Titan Funding Partners portal.

It’s basically a network of banks and lenders that raised over 32M… except your funding score isn’t affected, and you actually receive guidance to grow your operations.

So if you don’t want to be alone at this, talk to us and find how many partners are happy to connect with you without a FICO.

Some of our emails hit 15% CTR after hiring Max for our launch campaign. He went beyond our expectations! We also added over 100K leads to our list within two months. Thanks!

HM Rawat

"Max was directly responsible for our traffic and email list. He took care of everything, from social media planning to the landing page... with barely any guidance or time needed from us! Appreciate everything he's done and we hope to work with him again.

Ali DBG

"He definitely sticks out as one of the top 3 best cold email copywriters we've ever engaged. The results speak for themselves. Thank you for all the great work!"