There’s been a great stablecoin war going on for years. A war to bring more stability and adoption for crypto. And should this war be lost, it could put at risk the entire crypto market.

How? Centralization. Lack of transparency. Censorship. Regulation. De-pegging.

No stablecoin is risk-free. But one thing we’ve learned from Bitcoin and DeFi is that nothing is riskier than centralization. How many of today’s stablecoins are that way? Could there be others under the radar that potentially dominate one day?

Let’s find out.

Summary:

- There are around ten stablecoins that could position themselves in the next few years to be no.1 in market dominance. So far, only the top 3 stablecoins have remained unmatched since 2018.

- Despite each one having different advantages, today’s major stablecoins all share similar strengths and weaknesses, mostly derived from centralized, 1:1 fiat reserves.

- The first war was linear and among fiat stablecoins. But this stablecoin war includes new rivals that disrupt traditional dollar backing.

What Is The Best Stablecoin?

As we go through the stablecoins rivals, there’s one thing to keep in mind. Whatever projects are competing today may not be the best stablecoin. There are more unknown projects and “third choices” that might make the top 5 stablecoins soon irrelevant.

It’s like comparing world-class crypto-fiat exchanges to the Uniswap DEX. Stablecoins aren’t just about stability or volume but how they follow the dollar. Today’s top five are mostly private companies that control the supply and hold USD equivalents as reserves.

Tether is the best known, but there are other reliable ways to achieve $1.00 pegging. For example:

- A portfolio-based stablecoin that diversifies across other stables and blue-chip cryptocurrencies

- Stablecoins that mix different backing types, such as fiat, crypto, commodities (e.g. silver, gold), or algorithmic regulation.

- Collectively managed fiat stablecoins with many independent issuers

In short, the best stablecoin might not even be in today’s top 5 yet. There wouldn’t be stablecoin wars if there was a clear winner. Although in the first one, there was.

The 1st Stablecoin War: The Big Five

There was a time when Tether was the only known stablecoin. But over time, it was discovered not to be as secure as believed. A series of incidents in 2017 created an opening for new stablecoins— hopefully more reputable and transparent.

Thus the first war began among Tether, USD Coin, True USD, Gemini Dollar, and Paxos Standard.

USDT

Tether (USDT) was originally a fiat-backed stablecoin created by Tether Limited. There are +81B Tethers circulating at the time of writing but during the first “stablecoin” war, around two billion. Before Tether changed its reserve composition, all of these Tethers were supposedly backed by real US dollars, either in cash or bank accounts.

Tether had been around since 2014, with more than enough time to gain adoption across exchanges and wallets. This advantage made USDT easily the no.1 stablecoin until the appearance of newer ones, as well as transparency issues. Despite its convoluted history, here’s the summary of events around 2018:

- The leaked “Paradise Papers” revealed links between USDT and the Bitfinex exchange.

- Tether submitted many attestations (similar to a balance snapshot) but not a single formal audit. Friedman LLP was the first auditor, but Tether fired them for being “too exhaustive.”

- The OAG (New York Attorney General) started the Tether-Bitfinex investigation, later proving that USDT was NOT backed at all times. Both shared balances to avoid insolvency (e.g. on the Crypto Capital $850M incident) and prove their reserves.

In short, you couldn’t trust that Tether was 1:1 backed by US dollars. Others took advantage of this uncertainty to launch new— and hopefully transparent— stablecoins.

USDC

USD Coin (USDC) is a fiat-backed stablecoin founded in 2018 by Centre. This is a consortium between the Coinbase exchange and fintech company Circle. The promise is similar to Tether’s: 1:1 backing for US dollars or cash.

USDC launched with 25M tokens and soon increased to +200M (in 2023, it’s over 30B). Around 12% of USDC is backed by actual cash in reserve banks, and the rest is on a short-term US Treasury Portfolio (rarely longer than 2 months away from maturity).

USD Coin was built on Ethereum (ERC-20), meaning that USDC could leverage the growth of the dApp ecosystem. There was high demand for stablecoins, and USDC was backed by reputable companies. By contrast, Tether was obscure and originally anonymous.

Another selling point was its bank-like stability. Easily redeem for cash, send dollars worldwide without a $50 wire fee, or receive merchant payments without +2% credit card fees.

USDC might be the closest example of your ideal fiat stablecoin. This brings the unavoidable risks of centralization. Can Circle or Coinbase control what data is public on the attestations? Could USDC not be fully backed, or artificially minted to manipulate markets? Just because USDC is more transparent, it might not be that different from USDT.

TUSD

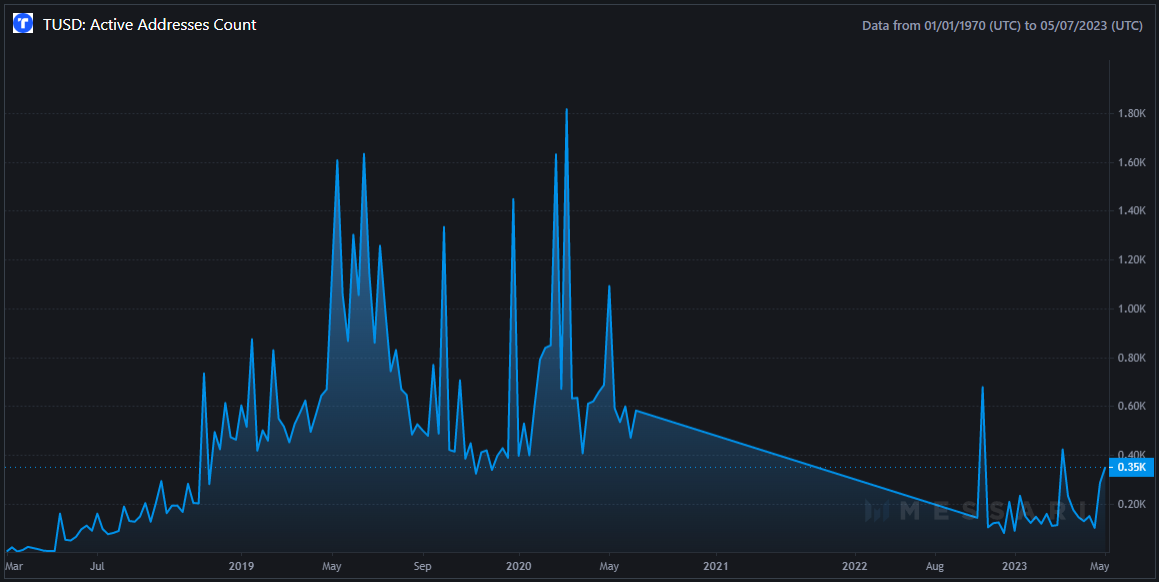

True USD (TUSD) is a fiat-backed stablecoin created by TrustToken Inc. It launched in 2018 and soon crossed $100m in circulating supply (now $2B). TrueUSD was the first stablecoin to guarantee real-time attestations or audits, and to this day, very few stables offer this.

Like USD Coin, TrustToken had seen the weaknesses of Tether and made it its strength. Transparency, both on-chain and off-chain:

- To ensure that no insider or attacker is artificially creating more TUSD, the supply is publicly verifiable on the Chainlink oracle. Basically, dozens of independent platforms report to Chainlink with the total exact balance of TUSD per blockchain.

- On the off-chain side, TrustToken keeps USD on escrow accounts with various banks and fiduciary partners. To calculate these, they use LedgerLens, a fintech platform that verifies and monitors all escrow accounts.

TUSD is the least known of the top 3 stablecoin rivals. While arguably safer than Tether, USD Coin was more popular. Even though it launched first, TrustToken Inc. wasn’t as established as Circle-Coinbase. TUSD started with a circulating supply of a few thousand tokens and wasn’t real-time audited until 2019.

USDC instantly had millions in circulation before anyone ever bought (either from the company or big Coinbase clients).

GUSD

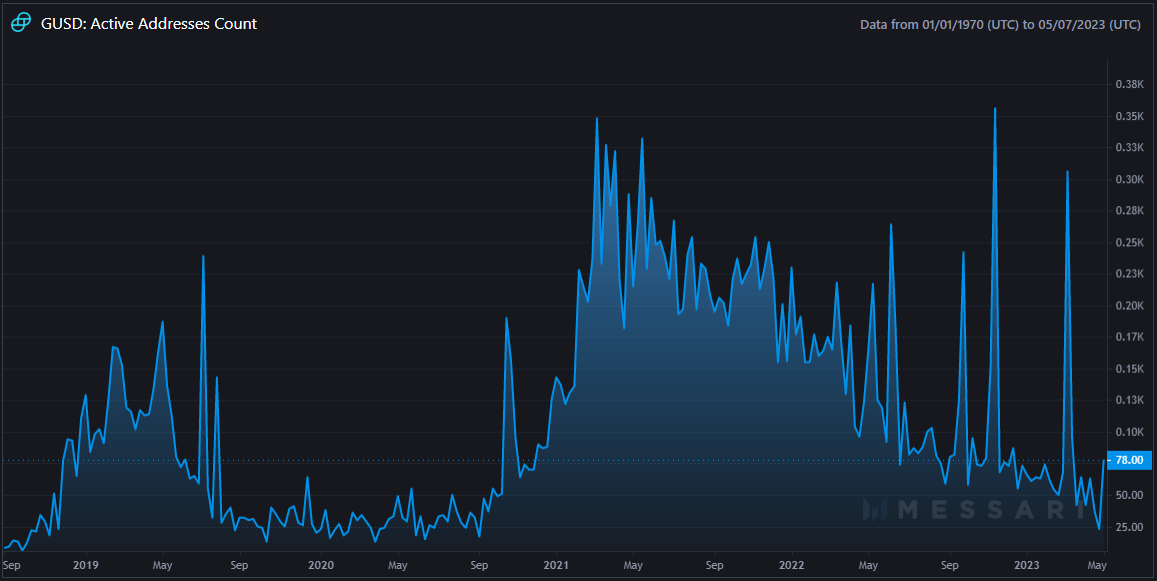

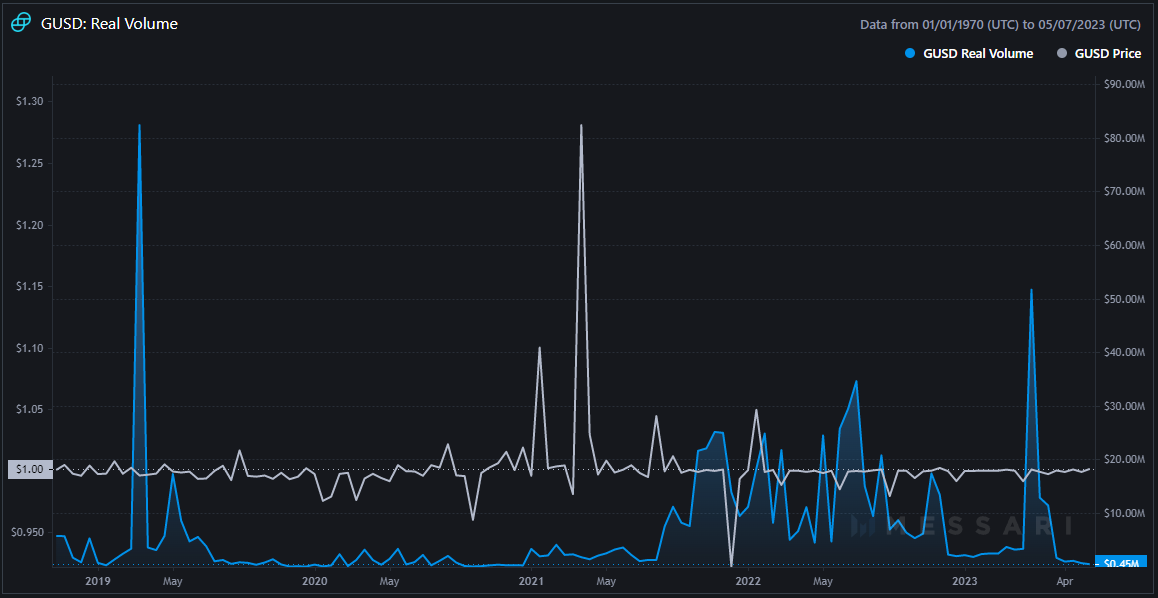

Gemini Dollar (USD) is a fiat-backed stablecoin created by Gemini Trust Company (also known as the Winklevoss twins). It launched in 2018 (three years after the Gemini Exchange) with roughly 20 million GUSD in circulation and reached 80 million the same year. Gemini Dollar is known as the first regulated stablecoin in the world.

When it comes to product-market fit, GUSD might seem redundant compared to the big three. But Gemini wasn’t exactly trying to create the leading stablecoin. Since the $850M incident, Tether became a risk for exchanges, hence the creation of the Gemini Dollar.

For investors, GUSD was synonymous with security. It was backed 1:1 by US dollars held in State Street Bank, and the stablecoin was approved by the NYDFS. However, all these regulations made its adoption slower than the others.

Before listing on major exchanges, GUSD was a niche stablecoin held mostly by institutions. The low availability, stiff competition, and late timing are the reasons Gemini Dollar did not win the stablecoin war.

PAX (now USDP)

Paxos Standard (PAX) was another stablecoin backed 1:1 by dollars that appeared in late 2018. Paxos Trust Company launched on major exchanges (Binance, Coinbase) with 20M tokens and over 100M by the end of the year (and in 2023, 1B). Paxos Standard (PAX) rebranded to PAX Dollar (USDP) in 2021 to better differentiate from other products like Paxos Gold (PAXG).

Like GUSD, PAX is regulated by the NYDFS. Paxos uploads attestations every month and keeps reserves across segregated US bank accounts. PAX is 1:1 backed by cash and equivalents (US Treasury Bills, similar to TUSD).

As of 2023, you may wonder why stablecoins like PAX exist. There’s no clear advantage over the other fiat-backed stablecoins. What’s clear is that 2018 was an uncertain year, and investors likely bought PAX to diversify their stablecoins.

Paxos would be just another boring stablecoin… until 2019 when it partnered with one of the biggest crypto platforms today. Thus, PAX indirectly restarted the stablecoin wars in 2021 to challenge Tether once again.

Where Are The Big Five Today?

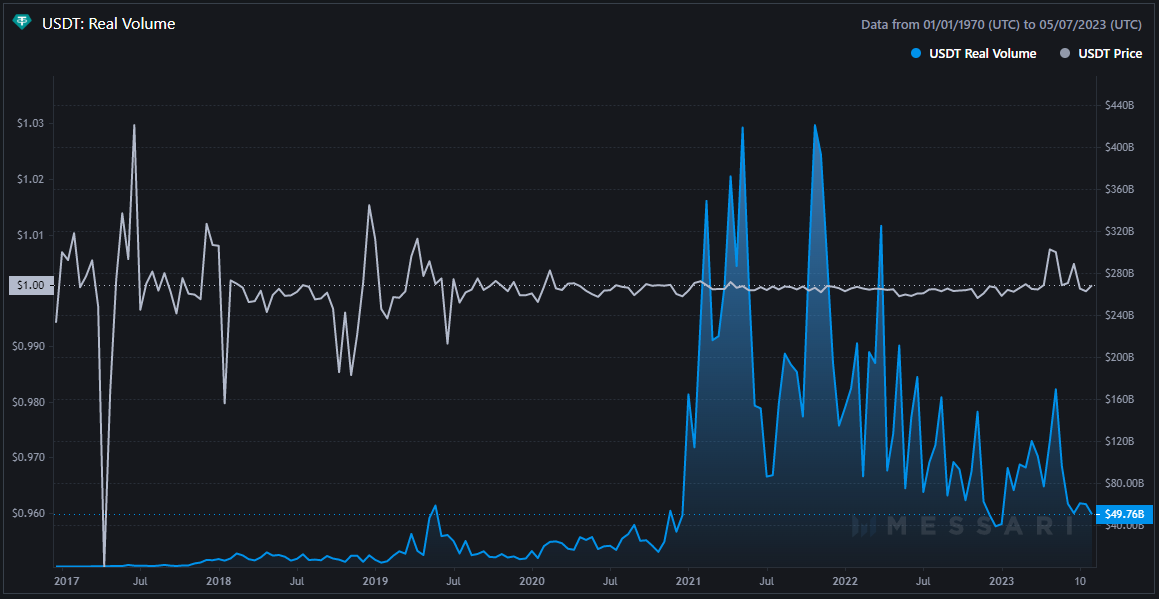

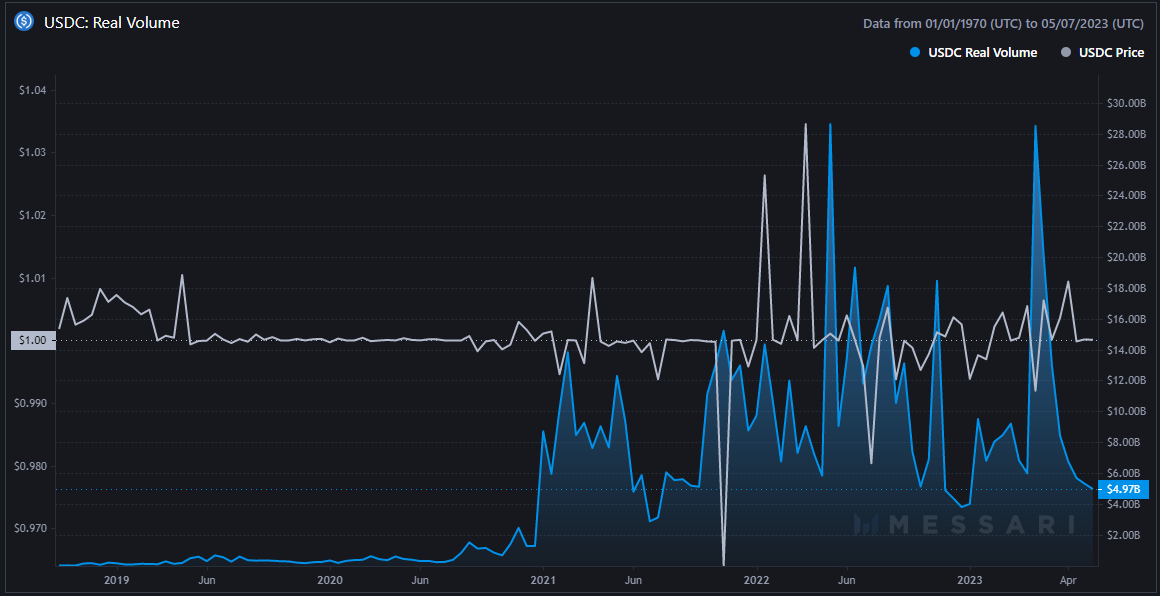

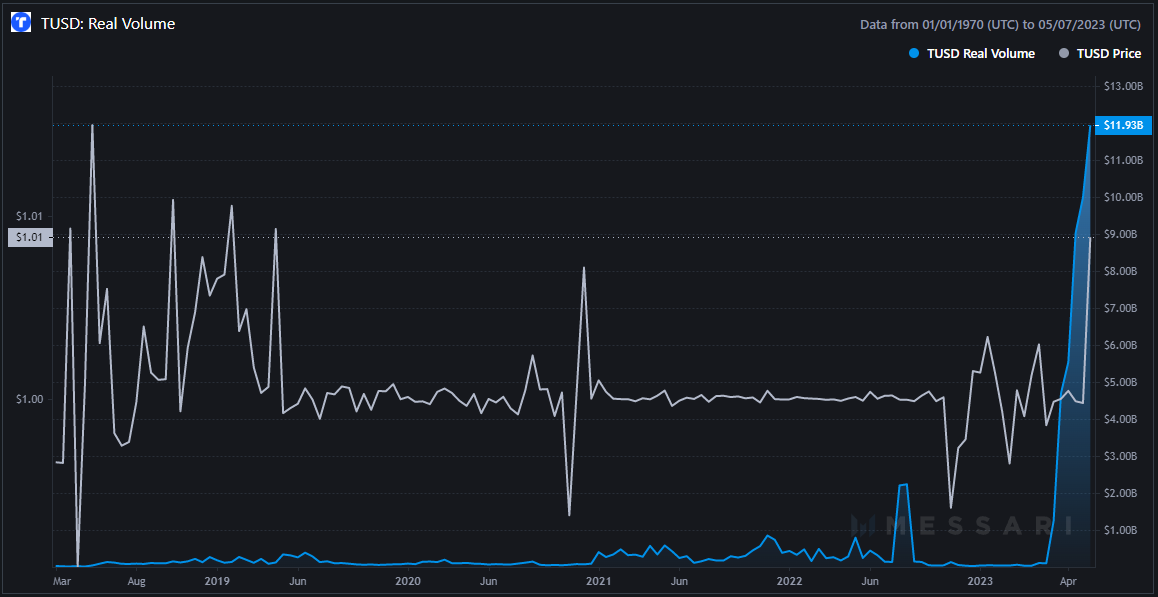

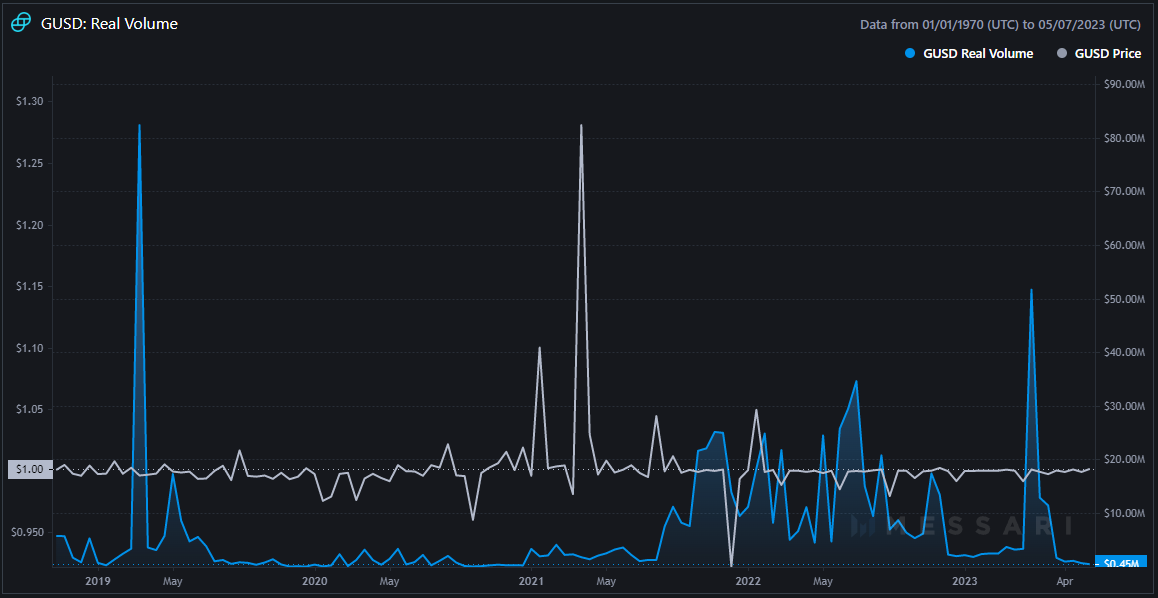

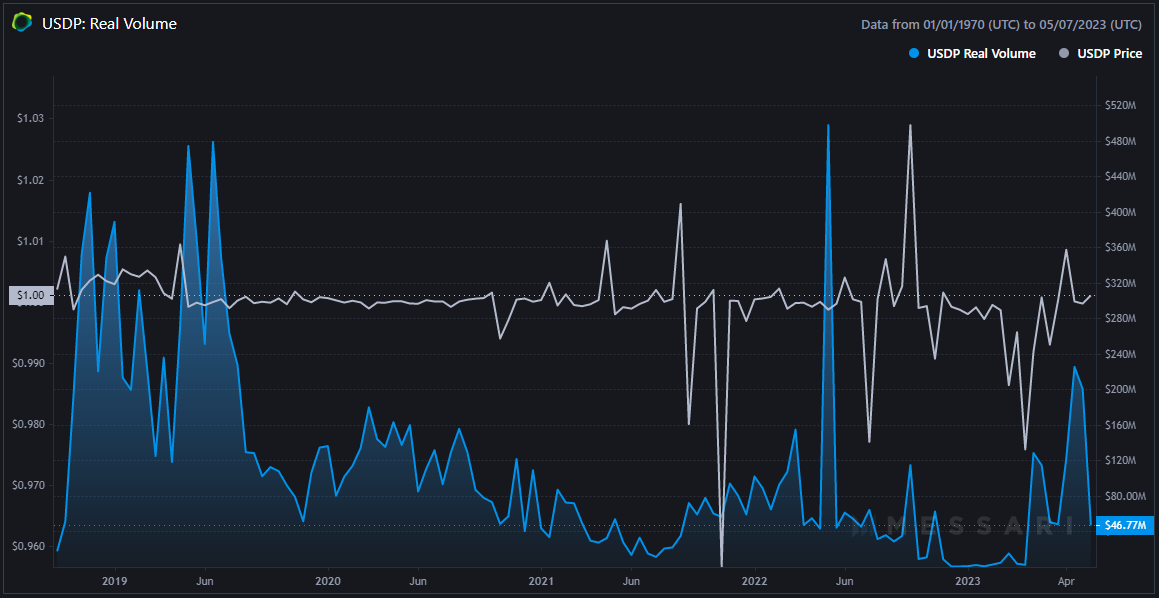

Here are the five stablecoins with their price history and real volume until 2023:

As you can see, Tether still leads in stablecoin dominance. The second rival, USD Coin, has about ten times lower daily volume. USDP and TUSD have similar volumes except for the recent spike (Binance related). USDP is PAX Dollar rebranded from Paxos Standard (PAX).

Two stablecoins are no longer top 5 by volume or market cap: USDP and GUSD. Gemini Dollar never really took off, and they were both outpaced by newer stablecoins.

As for stability, True USD has the lowest deviation, <2%. The most volatile was GUSD with frequent spikes over 10%. All other three averaged below 4%.

Note that True USD trades a daily average of around ~$40M, so it’s not necessarily safer. Arguably GUSD should also be because of size, but Gemini Dollar doesn’t have real-time reports, and TrueUSD isn’t tied to an exchange.

Also mind that when comparing on Coinmarketcap, volumes will be 10 to 15 times higher. Real volume isn’t necessarily 100% accurate but helps to simplify the comparison. So where does it come from?

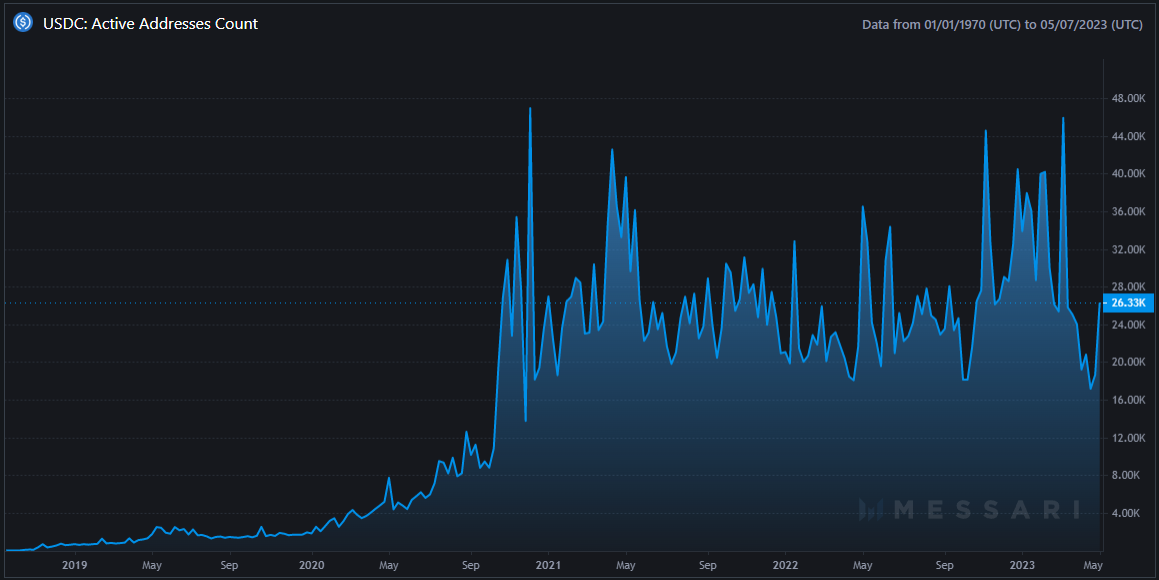

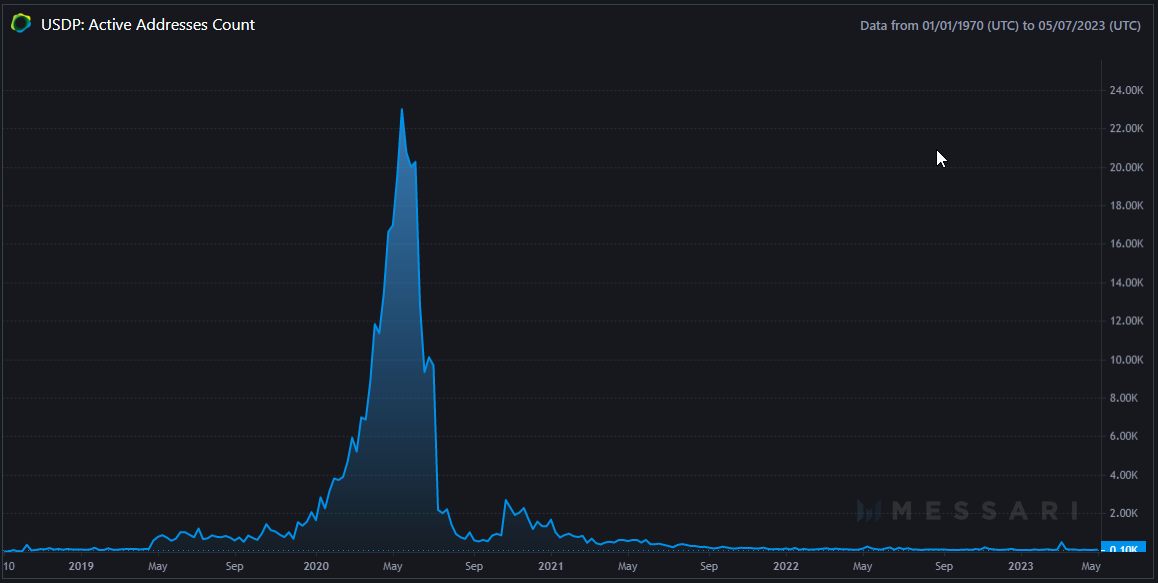

To better understand this volume, here’s the minimum of active addresses per stablecoin:

So USDT has over 1M active addresses, USDC thousands, and the rest less than a few hundred. Even in the second stablecoin war, Tether leads. But these numbers can be misleading.

Whether they are real accounts or alts, it comes down to Gresham’s law: bad money drives out good money. Given two currencies of identical market value, people tend to spend first the one with the lowest perceived value or reputation while holding the other one. So how many traders actually keep Tether or other stables?

Let’s check the total holders on the Ethereum mainnet. USDT has 4.36M holders, USDC 1.68M, TUSD 52K, GUSD 10K, and USDP 110K. This would be incomplete without checking the next two most popular networks:

- BSCscan: The total number of stablecoin holders on the BnB Chain is 7.63M for USDT, 635.17K for USDC, 16.5K for TUSD, none (unsupported) for GUSD, and about 700 for USDP.

- Tronscan: On the Tron Blockchain, USDT has 24.59M holders, USDC 376K, TUSD 310K, and none on GUSD/USDP (unsupported).

In total, USDT, USDC, TUSD, GUSD, and USDP have respectively 36.6M, 2.7M, 378K, 10K, and 110K holders.

Lastly, here’s the total share held by the Top 100 accounts on Ethereum, including trustless wallets. (The percentage tends to increase on the other chains.) The Top 100s own 38% of all USDT, 44% of USDC, 93% of TUSD, 99% of GUSD, and 93% of USDP.

Realistically, USDT and USDC are the only fiat-stablecoins that can compete for dominance. TrueUSD will remain because of its unique value proposition (real-time transparency), and while it seems too far from these giants, there’s a remote chance to become no.1. Recently, the Binance CEO chose TUSD over BUSD as the only stablecoin exempt from standard exchange fees. Hence the sudden spike from $40M to $11.9B in daily volume.

For GUSD, it’s a lost battle. Most of its use will stay at Gemini Exchange. If we see another Tether incident, however, investors might show more interest in this regulated option.

USDP also stalled, but Paxos has pivoted to commodity stablecoins too. Paxos Gold (PAXG) has seen as much success as Tether Gold (XAUT).

The 2nd Stablecoin War: New Rivals

The first stablecoin war was about the best fiat stablecoin. If anything went wrong with USDT (as many times before), either USDC or TUSD could lead. But Tether may not win the second stablecoin wars, because it’s no longer just about fiat-backed tokens.

In this ongoing war, GUSD and USDP are replaced from the top five with BUSD and DAI.

DAI

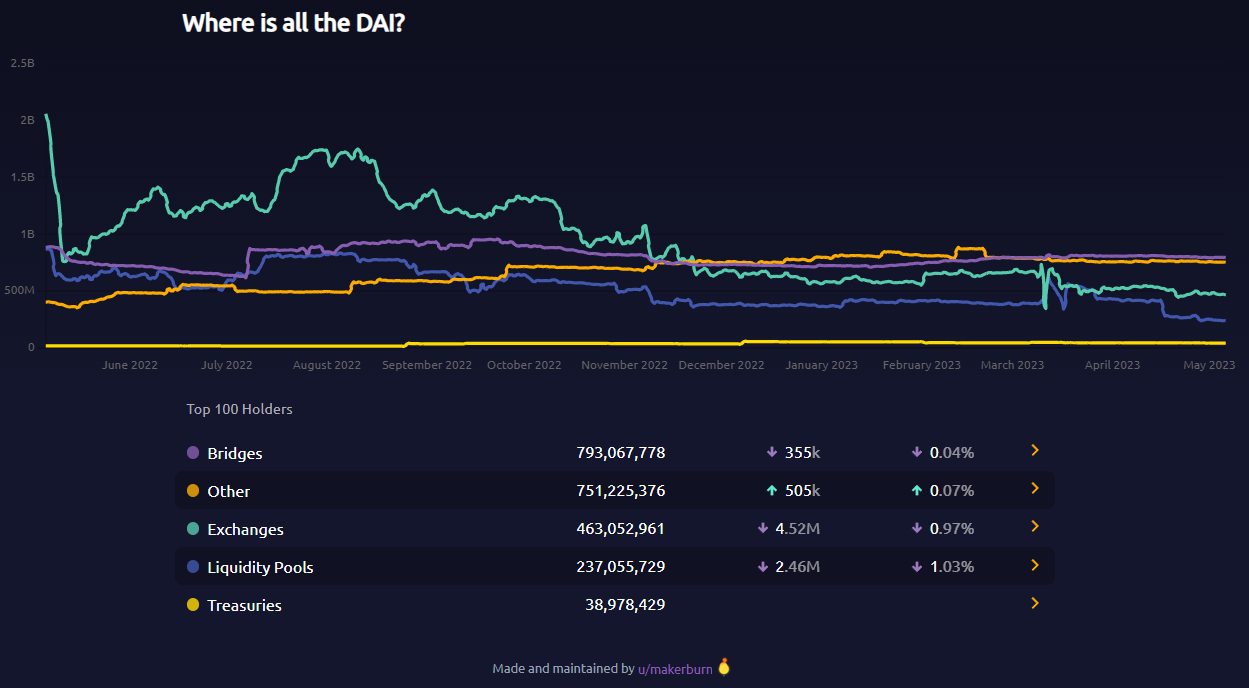

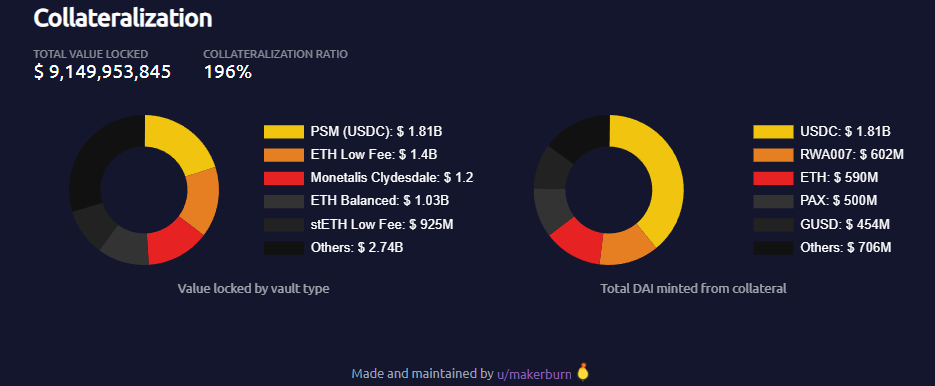

Dai (DAI) is a decentralized stablecoin that appeared in 2017 on the first-ever DeFi dApp, MakerDAO (MKR). Its supply has steadily increased from <10M to almost 10B from 2019 until 2022, now at 4.7 B. Every token is backed by multiple stablecoins and cryptocurrencies.

The tokens and proportions depend on the MakerDAO’s governance. Regularly, those who hold MKR tokens can propose or vote on what the Dai allocation should be. It’s like a collectively-managed mutual fund.

Dai is often called a crypto-backed stablecoin. This isn’t accurate when the majority of backing comes from centralized, fiat-backed stables.

+

There’s no real “diversification” when most token prices are correlated. Regardless, Dai is a safer stablecoin for its variety and collateral minimum of 150%. These reserves are all on-chain across different networks and smart contracts.

It’s clear that Dai took off for being one of the first stablecoins with non-fiat backing. But when it comes to the Top 5, it’s by far the least adopted stablecoin. A few reasons for this are:

- Dai launched in 2017 and was unknown until mid-2019, once the first major exchanges listed it.

- Prior to that, the only way to get Dai was with a Web3 wallet. DeFi wasn’t common enough until late 2020.

- Maybe investors didn’t like every coin on the Dai allocation and preferred to diversify themselves.

Still, Dai averages a daily volume of ~$30M outside the bull market. The price spiked to 1.08 once in 2020 and since then rarely deviated over 3% from $1.00.

BUSD

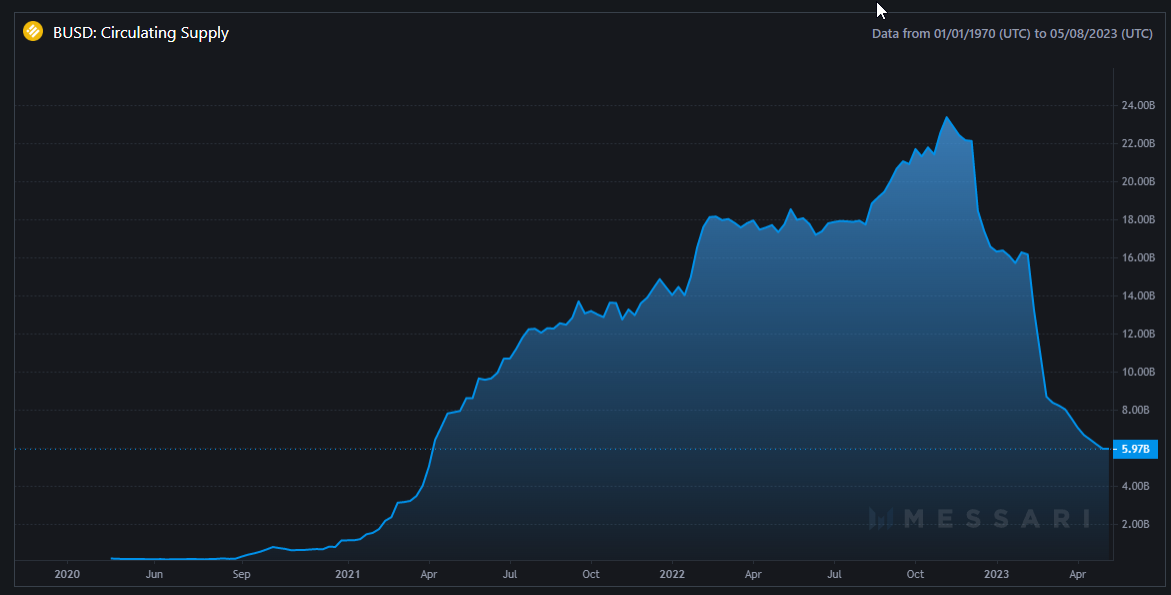

Binance USD is the most recent major fiat stablecoin. Besides its ties to the largest centralized exchange, BUSD is just another stable backed 1:1 by US dollars. It launched in late 2019 with 20M tokens and rocketed above 15B with the beginning of the bull run in 2021.

BUSD was slowly but surely gaining adoption. If you add the market cap of all stablecoins, Binance USD has consistently kept dominance of over 6% — and at its peak, 15%. USDT lost a bit of volume and the future looked bright for BUSD… until the SEC stepped.

In February 2023, the Security Exchange Commission redefined BUSD as a security. BUSD was an NYDFS-regulated token issued and managed entirely by Paxos, the same company behind USDP. And while the stablecoin itself had no incidents, this means that BUSD is now an unregistered security.

Thus, the SEC sued Paxos for BUSD. Paxos will no longer mint new BUSD but will continue redeeming BUSD for USD or USDP. Binance CEO “CZ” expects the BUSD supply only to reduce over time, which is why he replaced the stablecoin with others like TrueUSD for the exchange. If the BUSD supply doesn’t go to zero, it will remain as an abandoned stablecoin.

To this day (May 2023), BUSD never de-pegged from $1.00 by over 2%, except for $0.97 in March 2020. Even with a sharp demand for redemptions. “The end of BUSD” is a successful case of stablecoin deleveraging, if not the only one.

But what’s next? What does it mean for other stablecoins? Are they going after Pax Dollar now? And why?

Strictly, Binance should NOT be a security. It doesn’t pass the Howey Test and there’s no expectation of profit. One possible explanation is that BUSD granted several perks on Binance Exchange, which does offer investment products. Pax Dollar isn’t linked to a trading platform, so there should be no legal issues. Same with all other stables except for Gemini Dollar.

But there’s another intention that could threaten Tether and all fiat stablecoins. The “dark horse” of stables, you could say. But first…

Secondary Stablecoins

It’s unclear how this second war will end. We do know that by the time the first one ended, both DAI and BUSD already existed. They’re now top five, and now with the SEC intervention, it will soon be outdated.

The stablecoin environment is always changing, and the best one may not be on the radar yet. Here are other underrated coins from most to least relevant:

Liquity USD (LUSD)

Launched in 2021, Liquity is an algorithmic stablecoin linked to Liquity, a protocol for decentralized borrowing. It’s backed by at least 110% of Ethereum collateral, and it automatically adjusts to always be worth 1 LUSD per US dollar.

To maintain this proportion, Liquity implements stability pools, variable fees, variable supply, staking, and other mechanisms to liquidity or redeem LUSD.

Even though daily volume is erratic, its biggest spikes are correlated with stablecoin incidents ($36M spike after BUSD’s, $120M after USDC’s). With only 270M of circulating supply, LUSD has kept its dollar peg with deviations below 4% since mid-2022.

The LiquidLoans USDL is the fork of Liquity USD and is exclusive to the upcoming Pulse Network. This blockchain imports all tokens and dApps from Ethereum and improves its efficiency.

Frax (FRAX)

Launched in late 2020, Frax is a hybrid between fiat-backed and algorithmic stablecoins. It’s pegged to 1 US dollar, but it’s not 1:1 redeemable. Instead, it’s backed by USD Coin (USDC) and Frax Shares (FXS), which is the algorithmic side of FRAX.

Now there are 1B FRAX and 0.5B FXS. The current USDC collateral is 94%, and it changes depending on price. If FRAX increases, it goes as low as 85% collateral.

Regardless, every time USDC deviates, it de-pegs this stablecoin.

Market-wise, FRAX has plateaued. This may change if it didn’t depend as much on USDC, and instead on FRX or a mix like Dai’s.

Terra Classic USD (UST, now USTC)

To the surprise of many, Terra Classic USD is still getting a steady $3M to $7M of daily volume at ~$0.01 (or +$12M on CoinMarketCap). After its crash in May 2022, USTC was and still is next to the Top 10 most traded stablecoins.

More than FRAX, LUSD, Pax, or Gemini Dollar.

Could it all be fake volume? Yes.

Will this stablecoin return to the top ranks? Probably never. Not even compete with secondary options.

The only reason USTC appears in this list is its activity. Since its crash, both UST and LUNA rebranded to a 2.0 version, either to recover some of the lost funds or revive the algorithmic stablecoin. Regardless, Terra/USD reminds us that even the biggest stablecoins can disappear overnight with the wrong fundamentals.

The Dark Horse Of Stablecoins

In an ideal world, stablecoins fairly compete for adoption based on transparency, reliable backing, and timely redemptions. But there’s another form of currency that can put all top 5 stablecoins at risk. Central Bank Digital Currency, or CBDCs.

The main issue is: these big stablecoins rely on fiat backing, including Dai.

For context, CBDCs are a centralized, on-chain form of digital money. Central Banks control their supply, and either these or the government can oversee the network. It’s a pseudo “cryptocurrency” that one entity can monitor and restrict without any privacy.

Again, normally these would coexist and compete like all other stablecoins. But government agencies don’t need to compete when they can regulate. We’ve already seen some CBDCs being tested, and governments haven’t been exactly libertarian.

The Chinese digital yuan wallet has +260M unique users (2022). It’s been driven by rewards more than penalties. As for cryptocurrencies, they were banned a long time ago.

The infamous eNaira (2022) wasn’t so encouraging. After unsuccessful discounts and bribes, the central bank steeply reduced cash withdrawals from 150,000 daily nairas to 20,000. This includes business accounts. Anything above 20k incurs 5-10% penalty fees.

For good or for bad, very few have tested, and those that succeeded had limited reach. But what happens when the USA develops a CBDC for the world’s reserve currency USD?

The point to keep in mind is, when governments claim the coexistence of CBDCs with alternative money, they’re not promoting equity. Any massive restriction that isn’t outright banning crypto would still be considered “coexisting.”

As CBDCs develop, their regulation will likely overlap with stablecoins. This could bring transparency to fiat-backed ones, assuming they don’t end up like Binance USD. If worst comes to worst, today’s top 5 stablecoins might be replaced entirely with DeFi alternatives, except commodity stables.

Who Is Winning The Battle For Dominance?

It appears the stablecoin wars continue the way they started: Tether on the lead in 2023, and probably for many months to follow. The top 3 stablecoins have solidified their rankings, and the last two of the group have changed every few years.

Spoiler: BUSD will not win the battle for crypto dominance. Dai also has a long way to go (in adoption).

In hindsight, Binance USD was close to becoming another “USC Coin” to potentially overthrow USDT. If regulators managed to stop BUSD, a perfectly working stablecoin with barely any deviation, what’s stopping them from taking action on USDT? If and when they do, it’ll likely change nothing.

Tether still keeps over 60% of stablecoin market dominance despite its questionable history. It’s been caught misleading users with its reserves and still leads regardless. The SEC might slow down USDT if they penalize it as an unregistered security, but the issuer is based in the Virgin Islands, where crypto isn’t as regulated.

There’s also a chance that USD Coin dethrones Tether eventually because of reputation and transparency.Another likely scenario is that, within the top 5, we soon see at least one truly decentralized stablecoin, whether it’s algorithmic or crypto-backed. Whatever regulations appear in the future, fiat stablecoins are the most risk-exposed. Among other reasons, that’s why the top 5 is temporary and there’s no clear winner in the stablecoin wars.