Blockchain technology is valuable because of its utility. Especially in DeFi, it has introduced assets like NFTs, utility tokens, and cryptocurrencies. But make no mistake: decentralization is more than finance.

A blockchain oracle examples how information can be a form of “asset.” Anything from market prices to sports, politics, or weather data. Never better said, knowledge is power.

The question is, who controls that power, and how reliable is it?

Oracles aren’t new. Blockchain oracles are. This difference creates new DeFi opportunities and could even reinvent mass media.

What Is a Blockchain Oracle?

If you’ve traded cryptocurrencies before, these oracles might sound familiar:

- Chainlink (LINK)

- Augur (REP)

- Band Protocol (BAND)

- Universal Market Access (UMA)

- Nest Protocol (Nest)

Here’s the complete blockchain oracle list.

You can see the Oracle market has a product-market fit. It has a $3.5B+ market cap, and some tokens have been highly-ranked for almost a decade. So what are they?

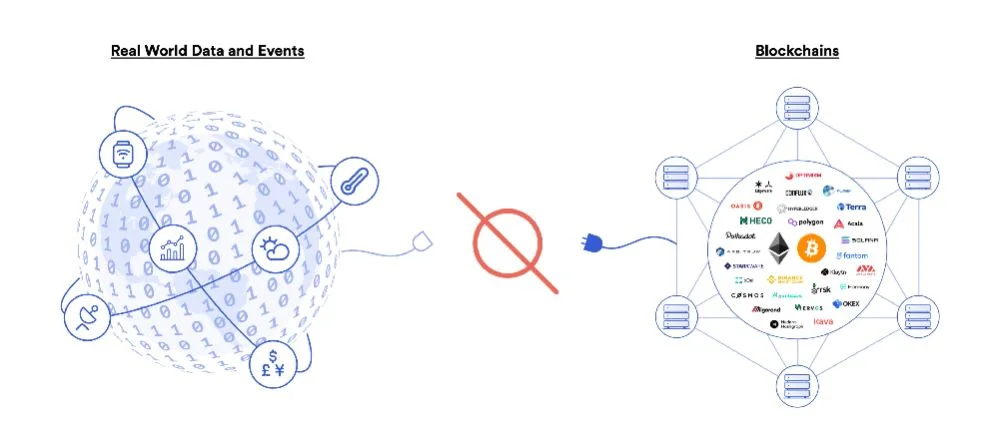

Blockchain oracles are infrastructure-type decentralized applications (dApps). They’re decentralized databases that supply other blockchain protocols with accurate, off-chain information. Examples of projects using oracles are Aave, Paxos, Pancakeswap, Compound, and Liquity.

Now, what does off-chain mean?

Off-chain data is every variable external to the blockchain, such as weather, sports scores, election results, or stock prices. Smart contracts can use this data as conditions to manage on-chain data. E.g., If Candidate A wins the US elections, send 1ETH to this user address.

Unlike off-chain data, on-chain data is blockchain-backed, public, and immutable. To link both types together, you need a trusted data provider, an oracle.

Why Are Oracles Important?

Oracles ensure the information used by others is accurate and reliable. If it weren’t, investors would unfairly lose money, and cyber-attackers could exploit smart contracts. Simply put, accounting fraud.

Why do blockchains use off-chain data? Because it tremendously increases the use cases and investment opportunities. It links real-world information to the blockchain, which makes possible Web 3.0., the Metaverse, and true DeFi.

Traditional oracles would be telecommunication, tech companies, and tracking websites. Users and businesses have been using these for years for “reliable” information. We rarely question it because these companies have high authority, large databases, and a long positive history.

In other words, trust. Hence why oracles and blockchain have been incompatible until recently.

The Ironic Oracle Problem

The purpose of oracles is to be so accurate and objective that no one ever has to question these. When you link oracles to financial services (because it’s trust-based) there’s an inevitable conflict of interest. Suddenly, businesses can choose between prioritizing revenue over the truth.

No matter how reliable, traditional oracles have the centralization, single-point-of-failure problem. You never know who might manipulate data: sometimes it’s cyber-attackers, sometimes it’s insiders.

And assuming nothing goes wrong, that data can still be different from other oracles. In finance, these inaccuracies mean a lot to big investors. Who do you trust?

Different Types of Oracles

Maybe you don’t have to trust anyone. Blockchain introduces new types of oracles that help us reach consensus. Most notably, decentralized blockchain oracles.

Unlike traditional ones, decentralized oracles do not supply information. Rather, they collect and verify data coming from dozens of centralized oracles. Platforms like Chainlink automatically update data every few minutes based on oracles’ responses and their data deviation.

Once enough platforms contribute with data, decentralized oracles become the most trusted trustless platforms on the Internet. This makes possible a wide diversity of data formats, which involves different types of oracles:

- Input/Output: Traditional (input) oracles collect data from the world and translate it for the blockchain. Output oracles take on-chain information and export it to external platforms. It can be traditional apps or other blockchains.

- Interoperable/Intra-operable: Decentralized blockchains are interoperable (AKA cross-chain compatible). This allows data sharing among incompatible blockchains. For example, a smart contract on Ethereum Mainnet could trigger another contract on the Solana blockchain.

- Software/Hardware: When using software oracles, on-chain data can affect applications outside the blockchain (e.g., unlock website content). If it’s hardware, either the input or the output is a physical result. It could be opening a door, printing a ticket, sensing temperature, detecting a flash drive, or reading vehicle speed for insurance smart contracts.

Note: Think of these as oracle services rather than types. Just because a platform provides input services, that doesn’t necessarily make it an input oracle. Large platforms like Chainlink provide many, if not all variations.

Oracle Use Cases

Few blockchain oracles are as popular as Chainlink. Not only is it the earliest example but also has the most use cases. You’d be surprised to know how many well-known projects use it, which makes possible…

- Dynamic NFTs for Layer 2 on Aave

- Improved security for cross-chain wrapped tokens on Celsius

- Accurate price fees for Avalanche DEXs on Trader Joe

- Decentralization of token supply regulation on Ampleforth

- Blockchain-based parametric insurance on Otonomy

- Expanded stETH adoption on Lido.fi

- Decentralized price feeds on the Synthetix exchange

- Secure multi-chain borrowing on QiDao

- Data fees for binary options markets on Thales

- ETH/USD Data fees on Liquity, securing $2.7B TVL

While these are the most known ones, there are countless oracle use cases. We can only expect case numbers to increase due to the demand and utility of decentralized data.

How Essential Are Oracles In DeFi?

When it comes to decentralized applications, DeFi is the most dominant category. Dapps require smart contracts to operate. And the utility of these contracts depends on infrastructure and how much data is available.

While dApps can use on-chain data, the best real-world use cases come from real-world data. If decentralized oracles can link that information to networks like Ethereum or Pulsechain, there’s no limit to what entrepreneurs can create. From fiat on and off-ramps to Web 3.0.

Blockchain oracles are increasing dApp utility, and smart contracts are essential for DeFi protocols. In this Information Age, it’s not whether decentralized oracles will remain relevant or not. The question is: Which one will be the best? Maybe Chainlink remains at the top, maybe a newer oracle becomes no.1.

Either way, investors consider them safe long-term investments because of how they reinforce DeFi protocols. What’s more, oracles can help us regain clarity in a noisy digital world, overcoming fake news and information overload.